How Does Self-Management Make You a Better Crypto Investor?

Most investors focus on finding new projects and trying to predict market moves. We don’t know the future, but we can prepare better for different scenarios. This is the reason why self-management is a crucial skill for an investor to have.

I wrote before about different processes from the Crypto Investment Framework. Now, I would like to show you what skills are needed to find success as an investor. These competencies can also be used in professional and personal lives.

I want to introduce you to the concept of self-management. We can manage many things like business, portfolio, or people, but we should always start with ourselves.

Self-Management can be divided into five areas:

Goals management

Time management

Energy management

Focus management

Emotional management

I will briefly discuss every one of them in this article and show you how you can use them together to become a better investor.

Goals Management

Goals allow us to focus on the most important things. Don’t just think about them; create a system for achieving them. Goals are about the results you want to achieve. Systems are about the process that leads to those results. Remember, the more you let a single belief (goal) define you, the less capable you are of adapting when life challenges you.

Goals without a system won’t solve your problems:

Winners and losers have the same goal

Achieving a goal is only a momentary change (we need to change a system that causes those results)

Goals restrict your happiness - you either achieve your goal and be successful or fail and be a disappointment

Goals are at odds with long-term progress - it's not about a single accomplishment. It’s about a cycle of endless refinement and continuous improvement

Many people use the SMART methodology for designing goals:

Specific: Well-defined, clear, and unambiguous

Measurable: With specific criteria that measure your progress toward the accomplishment of the goal

Achievable: Attainable and not impossible to achieve

Realistic: Within reach, practical, and relevant to your life purpose

Timely: With a clearly defined timeline, including a starting date and a target date. The purpose is to create urgency.

I wrote a guide before on setting your investment goals:

Why are you investing in crypto – what are your goals?

How do you want to achieve them – what is your system (investment strategy)?

Another important aspect of goal management is the decision-making process. We can consider this as determining whether a decision is good or bad. This means examining the quality of the beliefs informing the decision, the available options, and how the future might turn out given any choice you make.

Time Management

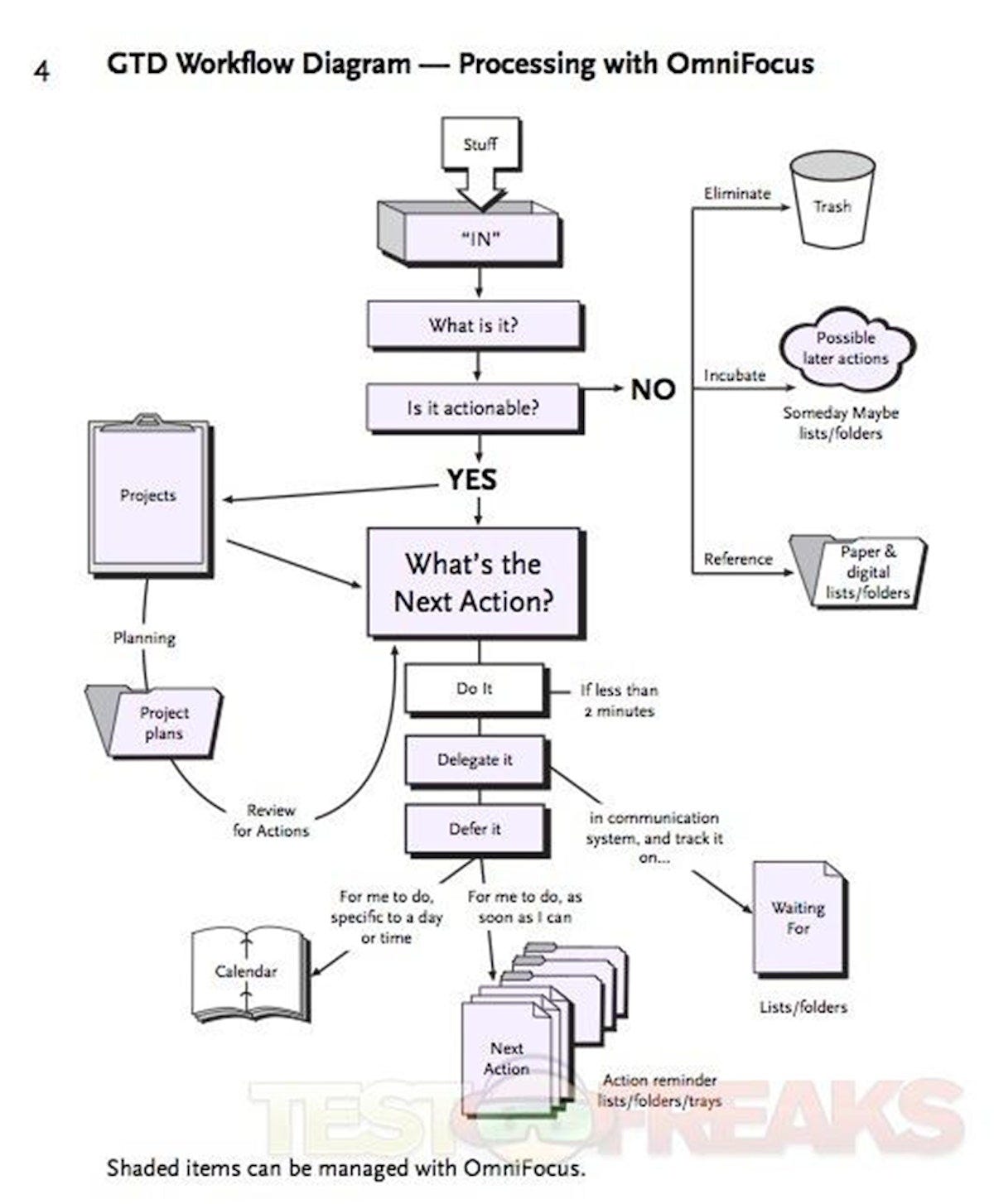

When you decide what is the most important for you and how you want to achieve it, you need to find time to do this. Time Management allows us to optimize the usage of our time. The most popular framework is the Getting Things Done.

I encourage you to read this book or check other GTD materials.

Procrastination is a hot topic now. Most people have heard about it, and even more experience this daily. The key to overcoming procrastination is to understand this phenomenon better.

Why do we procrastinate? And how can we prevent it?

Boring -> it's normal if you're just starting out

Frustrating -> limit the time of working on the task and often switch context

Difficult -> divide into small parts and do it when you have more energy

Unstructured or ambiguous -> create a plan

Lacking in personal meaning -> give it meaning

Lacking intrinsic rewards (i.e., it’s not fun or engaging) -> give yourself a reward

Habits are also a powerful tool in your struggle with procrastination. Small changes often appear to make a difference once you cross a critical threshold. The real reason habits matter is because they can change your beliefs about yourself.

Crypto can consume all your time, so it’s crucial to spend it effectively. Start honestly evaluating your available time, and adjust your strategy. This is the reason why I am publishing a book, Cryptocurrency Investing - The Fundamental Analysis Guide – to optimize the process and save time.

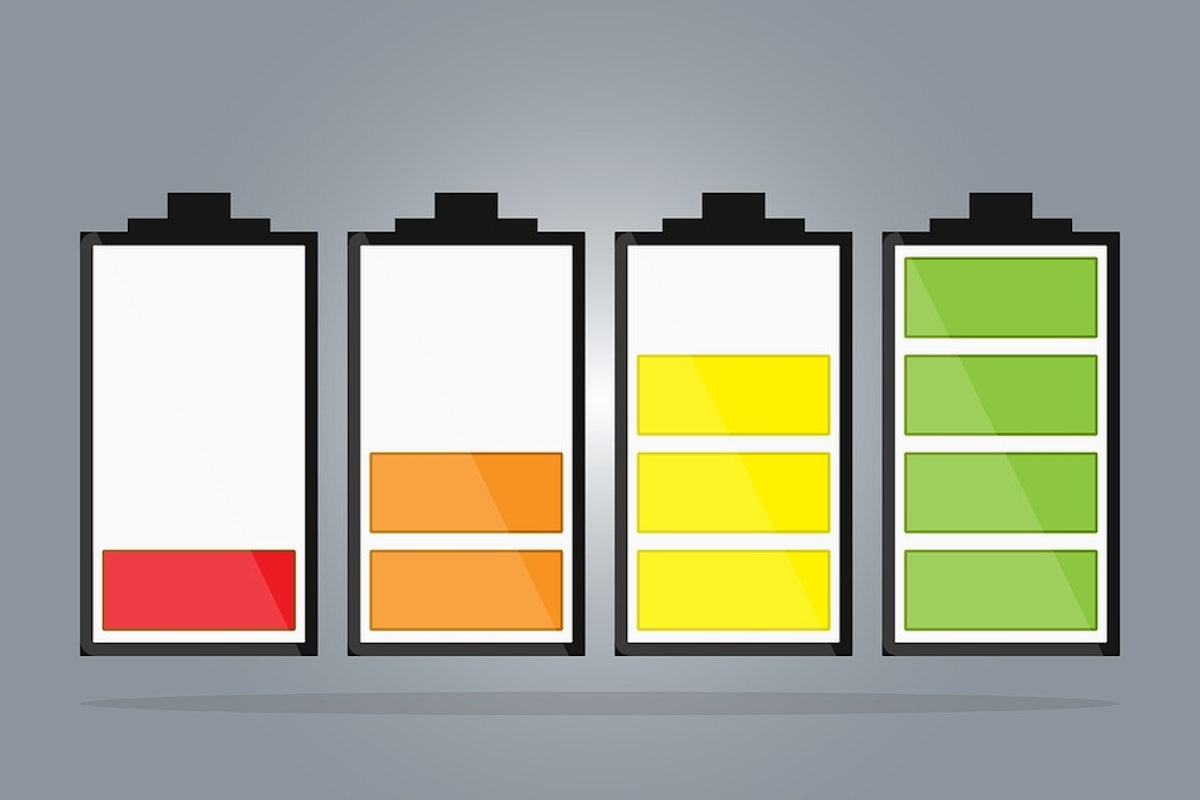

Energy management

When your energy decreases, your need for willpower Increases. Let me tell the story to check if it resonates with you.

Bill has a basic idea of why he is investing in crypto. He wants to be rich, but he is not thinking about any specific goal – “Let’s see how it is going.” Bill also doesn’t have a written investment strategy. He wants to buy low and sell high new promising projects.

To do this, he has booked a 30-minute time slot each evening and half of Saturday. During this time, he doesn’t just want to find new projects and learns more about crypto investing. What is DeFi farming or Substrate?

Unfortunately, he doesn’t have enough energy to follow his strategy and spend this time as he planned. Saturday also doesn’t work because there is always something more substantial. As a result, he only invests in DeFi projects promoted by the biggest Twitter and YouTube accounts.

You can fail even if you have a clear goal, a strategy to achieve it, and time to execute it. You need the energy to do it. Think of willpower as another resource like time or money.

Every act of willpower depletes willpower -> using self-control can lead to losing control

A consistent act of self-control can increase overall willpower -> you can train it

There are no shortcuts when we talk about willpower. A healthy lifestyle is the most significant contributor to it. Focus on:

Sleep

Diet

Training and physical activity

Distress tolerance (limiting stress impact on your life like mindfulness, hormesis, or breathing exercises)

Supplement (if needed)

Focus management

Information is no longer scarce, but attention is. Focus is our mental stamina which helps us recognize the signal from noise.

Most of us lose focus because of the following:

Lack of interest, not liking it -> Goals management

Negative emotions, afraid of screwing it up, hard/unpleasant -> Emotion management

Poor organization -> Time management

Low energy levels -> Energy Management

Lack of control -> Environment and external factors

As you can see, we can mitigate all main reasons for losing focus through better self-management or changing the environment. If we maintain it long enough, we can achieve a flow state.

Flow is an optimal state of consciousness, a peak state where we both feel our best and perform our best. It is a product of radical neurochemical, neuroelectrical, and neuroanatomical (large swatches of the prefrontal cortex deactivated, our inner critic shut off, and our inner monologue rendered silent) functions triggering the whole-body transformation.

All of this also applies to crypto. Think about what your biggest struggle is that limits your crypto gains.

Emotion management

Emotions greatly impact us, regardless of whether or not we are aware of them. They consist of the following:

Thoughts ("I am getting nowhere with this)

Feelings (tense, upset...)

Bodily sensations (tense shoulders, churning stomach)

Impulses/behavior (escaping...)

Why do we have them? Emotions have many functions in our lives. Like:

Signaling the meaning of the event to self and others

Enlisting social support

Regulating behavior

Maintaining social control and hierarchy

Organizing activity

Influencing cognitive processing

As investors, we also constantly deal with stress. Stress is not good or bad but can lead to bad or good output. This is information and energy we can use to make adjustments. I like to think about stress as a gap between demand (environment) and our capacity (time, money, physical energy).

Knowing this, stress is not a feeling; it’s insight:

Look into the information it's trying to provide. Ask clarifying questions to get to the core (what is going on)

Appreciate that you are aware of it (feel grateful about it)

Use that same energy to fuel some sort of action

Stress management can be the most crucial skill during a bear market. Investment is not a sprint; it is a marathon. You can lose in a short time horizon but win this game in a long-term horizon.

Check also my upcoming book with other frameworks to be a better crypto investor.

I especially recommend it for people who want to:

Invest in crypto using an evidence-based approach

Use knowledge and experience from traditional finance

Learn all investment aspects in one place

Broaden their horizons by learning new things at the intersection of crypto and other fields